FilmSlate I: Strategy & Ideation

Indie Film Streaming Platform

Comprehensive onboarding initiative to explore user problems and drive clear organisational goals in the online streaming industry.

Overview

FilmSlate, an online indie film streaming platform focusing on curated quality content, whose value proposition is stated as:

“FilmSlate- Where every frame matters and every film is handpicked for you. We believe streaming services should be more than just endless scrolls and generic recommendations. At FilmSlate, we carefully curate one film every day and have a library of up to 30 films ranging from the best of indie cinema, and hidden gems to forgotten classics. Here we inspire your power to discover in cinematic development, through art, through emotion, through the smallest detail for every community to keep you at the forefront of every film slate.”

To aim at increasing the user subscription rate from 32% to 40% after the trial period, I have identified the main user pain point as a lack of personalisation during the sign-up & onboarding process. The new feature proposed here will try to resolve increasing user-recognised value early on with FilmSlate (Megyeri and Szabó, 2021).

Feature Ideas

Automatic taste profile creation and associated recommendation system during the sign-up and onboarding

---

The introduction of a personal taste profile marks a pivotal shift in the user onboarding experience journey (Belarbi et al., 2019). Right after the sign-up process, users are prompted to select their interested films (films chosen from representative genres and topics like director, festival, production studios, etc.) though a collection of “movie posters” with their “feature information” given. All related tags from the selected movies will get weighted and form the foundation of user taste profile. This simple yet crucial step allows users to feel recognised from the outset, enhancing their sense of personal value.

Furthermore, the automatic recommendation system takes this personalisation a step further. With users' taste profiles, the system will match and rank the top seven films from our collection, showcasing them prominently on the main page as the "top-taste" section. This not only streamlines the user's discovery process but also reinforces their personal connection to the platform.

The benefits of this approach extend beyond mere user satisfaction. By engaging users in their expression of personal taste and confirming them earlier on, this feature will foster a sense of ownership and investment in FilmSlate. This, in turn, leads to more intuitive navigation and increased engagement with FilmSlate content (Das and Ranganath, 2013), laying the groundwork for long-term user habits that will later transform into a subscription motive.

Product Goal and OKR

The goal of this feature is clear, under the OKR structure, I’ve identified a main feature objective to enhance user engagement through personalised value recognition. The following key results are also designated to mark the achievement of this objective, such as:

-

Key result 1 – First-three-day engagement (session duration) increase by 30%

-

Key result 2 – First-three-day cancellation rate drop by 20% (First-three-day retention rate increase by 20%).

-

Key result 3 – End-of-trial user satisfaction increased by 20%

Here two success metrics that contributes to FilmSlate’s North Star Metric (NSM), “Annual Subscriber Revenue (ASR)” are chosen to ensure the feature is serving its intended user value.

-

Time to key action completion. Specifically, the time from completion of taste profile question (without skipping) during sign-up, to the engagement with top-taste films, marked by the time start watching or saved for later.

-

Session duration, which here specify on the number of hours watched on top-taste film compared to total watch hour.

Central to this selection is the emphasis on NSM proxy metrics of “engagement” and “frequency”. They guide our efforts in the design and development process, by focusing on adoption speed and engagement, we ensure that our feature not only enhances the sign-up and onboarding experience but also encourages sustained usage of the platform. Ultimately, driving higher retention and conversion.

Market Analysis

FilmSlate however operates in the UK SVoD market amidst existing mainstream giants (Ofcom, 2023), it competes mainly within independent content streaming sub-sector, where key players like MUBI, IndieFlix, Kanopy, and BFI player are positioned. With this niche market experiencing significant growth in users, revenue, and business operation scale (Variety, 2023; Welk, 2024), it’s expected to see a bigger growth compared to overall SVoD market forecasted at a CAGR of 7.59% over the next three years. (Statista, 2024)

Competition in this landscape revolves around providing quality films from wider aspects from artistic and cinematic perspectives. For example, MUBI acted as a stricter gatekeeper to curate films according to social themes/trends (Smits and Nikdel, 2019), while IndieFlix provides proactive social, and educational impact. Using Porter’s five forces (see Appendix 1), the distributor roles of most competitors allow proximity to knowledge and production sources creating market entry barriers. Intense rivalry and substitution threats exist due to similar knowledge levels shared among competitors. Although FilmSlate currently faces a competitive disadvantage in bargaining power with suppliers because of its operation scale, its niche focus on personal curated offerings mitigates customer bargaining power.

FilmSlate's current proposed feature idea only adds to its unique advantage on human-curated film and newsletter’s information and community-building efforts. By offering a tailored user experience through higher autonomy and choice fatigue mitigation (Berman and Katona, 2016), FilmSlate can differentiate itself from our main competitors who failed to cater to individual user’s needs and foster stronger service recognition and engagement.

User Analysis

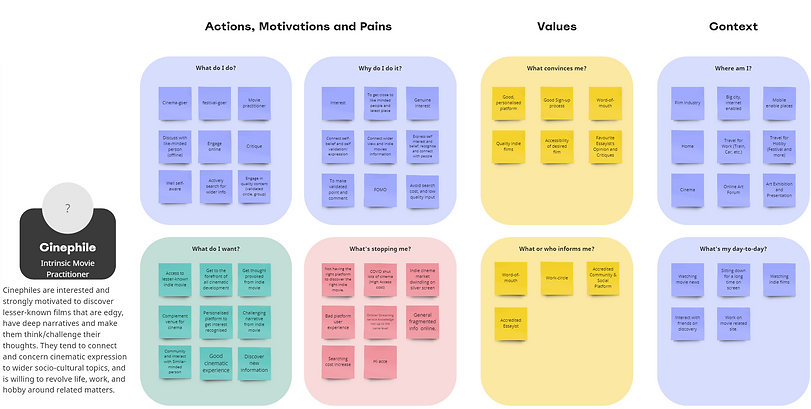

FilmSlate's user segment includes cinephiles, indie addicts, and genre fans. But here we’d like to focus particularly on cinephiles due to their strong user alignment with the platform's core value of personalised content curation, therefore they’re expected to benefit the most from the proposed feature.

Through an empathy map (see below) Cinephile’s persona (see below) is represented by an early middle-aged movie industry specialist residing in an English-speaking metropolitan area with access to major cities across borders. This group of users are deeply passionate about discovering lesser-known films with edgy narratives that challenge their thoughts and connect to wider socio-cultural topics. They expect personalised recommendations and meaningful information about the underlying knowledge they can refer their expertise to. Despite challenges, Cinephiles actively seek access to high-quality indie films and are willing to invest time and resources to do so. Frustrated by mainstream streaming services flooded with low-quality productions; and by FilmSlate’s current lack of personalisation content for individual preferences, they crave a platform that not only provides tailored recommendations but also fosters community engagement with like-minded individuals. Their goal is to continuously expand their cinematic knowledge, connect with fellow cinephiles, and validate their tastes and opinions through continuous intake of quality films.

To synthesise the user problem this proposed feature is focused on resolving, we get the problem statement:

I am an early middle-aged movie industry specialist, trying to explore and engage with quality indie film content that resonates with my personal tastes. However, I find it hard to get a single source of access to quality films because most indie streaming platforms fail to feed my personal tastes and knowledge-based information required from a film. This makes me feel very frustrated, as it forces me to expend additional time and resources on alternative avenues to get marginal results.

This specific user problem revolves around personalisation and also extends to indie addicts and genre fans who also mentioned the impersonal onboarding experience; therefore, the proposed feature ideas are confident to be appreciated by diverse FilmSlate user base.

Product Market Fit

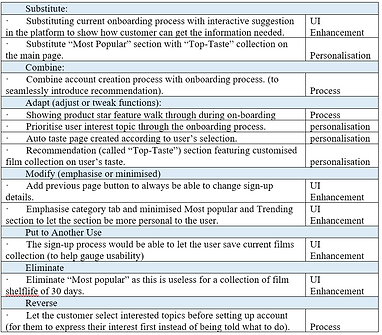

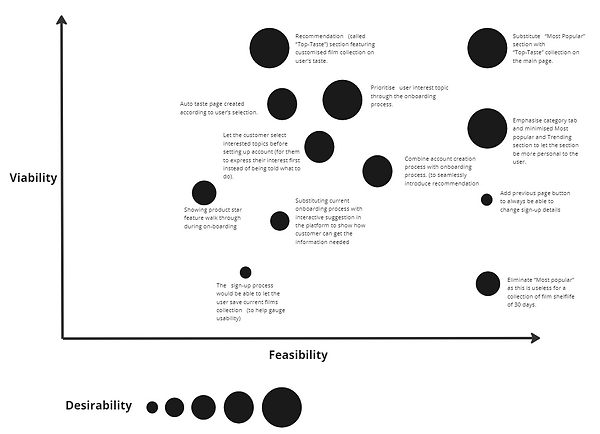

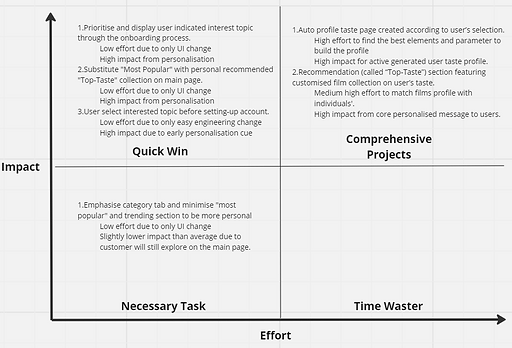

The ideation of our proposed feature idea focuses on the sign-up and onboarding process. Through the SCAMPER method, we identified several ideas that focus on personalisation and process optimisation, and amongst them, several opportunity themes were identified, UI enhancement, personalisation, and process optimisation (as seen below, and Opportunity Solution Tree ).

Later, all ideas are mapped to three lenses of innovation tools (see below). Through this round of idea selection, it’s deemed that ideas with either viability or desirability lower than medium will be eliminated as these either can’t contribute to enough user satisfaction through problem-solving or will be hard to sustain in the long term. For example, the idea to simply eliminate the meaningless “most popular” section due to its short (30-day) shelf life might not convey enough benefits to users; the idea of show star feature might increase usability, but with time, feature iteration might result in high maintenance and a confusing message sent.

Finally, through the impact/effort matrix (Appendix 3.4), the top two related ideas are selected as the top valuable feature ideas to create:

(1) an automatic user taste page from a user’s selection and

(2) create a recommendation “Top-taste” section featuring customised film collection fits to individual user’s taste profile.

At the same time, this study will also test the idea of substituting the “Most popular” section with “Top-taste” collection in the section below-featured films for its relevance and immediate visual impact. The two ideas left are dropped due to the lack of enough relevance and justification to influence immediate engagement.

Graph 1. Final Modified Prototype

Overall, we created 2 main prototypes the first one was subjected to user concept testing interviews and the latter one was modified according to relevant user feedback (Graph 1). We summarised potential users’ general cognitive and behavioural requirements reflected below:

More feedback mentioning further UI suggestions on the current product or irrelevant to the features are dropped after identification.

Finally, the final proposed prototype (Graph 1) is modified by synthesising information. The feature will be situated right after sign-up and at the beginning of onboarding, by using a film cover poster, and featured info instead of text option to utilise heuristic visual and cognitive processing in our active profile building stage, within the options will include FilmSlate’s top-watched films and reputable indie masterpieces to gain response rate and profile validity. After profile selection and welcome message, the user will see the Top-taste list sitting right below featured movies, which is confirmed through interviews that both text and position had drawn new users' attention and have elicited initial user interest.

References

-

Megyeri, M. and Szabó, B. (2021). Investigating the effectiveness of user onboarding solutions with eye tracking: a case study on paint 3d. Ergonomics in Design the Quarterly of Human Factors Applications, 32(1), 48-55. https://doi.org/10.1177/10648046211026028

-

Belarbi, N., Chafiq, N., Talbi, M., Namir, A., & Benlahmar, E. (2019). User profiling in a spoc: a method based on user video clickstream analysis. International Journal of Emerging Technologies in Learning (iJET), 14(01), 110. https://doi.org/10.3991/ijet.v14i01.9091

-

Das, A. and Ranganath, H. (2013). When web personalization misleads bucket testing. Proceedings of the 1st Workshop on User Engagement Optimization. https://doi.org/10.1145/2512875.2512879

-

Ofcom (2023) Media Nations UK 2023, www.ofcom.org.uk. Ofcom. https://www.ofcom.org.uk/__data/assets/pdf_file/0029/265376/media-nations-report-2023.pdf (Accessed: March 29, 2024).

-

Frater, P. (2023) 'Variety,' Variety, 29 September. https://variety.com/2023/biz/news/losses-liabilities-revenues-mubi-uk-1235738284/.

-

Welk, B. (2024) 'IndieWire,' IndieWire, 22 March. https://www.indiewire.com/news/business/kanopy-library-streaming-service-profitable-interview-1234966061/.

-

Statista (no date) Video Streaming (SVOD) - UK | Statista market forecast. https://www.statista.com/outlook/dmo/digital-media/video-on-demand/video-streaming-svod/united-kingdom#:~:text=Video%20Streaming%20(SVoD)%20%2D%20United%20Kingdom&text=Revenue%20in%20this%20market%20is,US%245.48bn%20by%202027.

-

Smits, R. and Nikdel, E.W., 2019. Beyond Netflix and Amazon: MUBI and the curation of on-demand film. Studies in European Cinema, 16(1), pp.22-37.Berman, R. and Katona, Z. (2016). The impact of curation algorithms on social network content quality and structure. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2848526

-

Petter, S. (2008). Managing user expectations on software projects: lessons from the trenches. International Journal of Project Management, 26(7), 700-712. https://doi.org/10.1016/j.ijproman.2008.05.014

Appendix

1 Summary of Market Findings and Porter’s Five Forces

Now that UK SVoD market has reached its plateau stage after its boom since its 2019 pandemic, multiple mainstream competitors are competing for audience's watch time (Ofcom, 2024). Two-thirds (66%) of UK households are reported using at least one SVoD service in Q1 2023, and despite the cost-of-living challenge and post-covid watch-time decrease, SVoD market size is still projected to reach £3.39bn by 2024 (Statista, 2024). Top streaming services in includes Netflix, Amazon, Disney+, Now+, etc.

On the other hand, independent film streaming industry is seeing a totally different trend, as the likes of MUBI, IndieFlix, Kanopy, BFI player all emerged from the market with growing user. Amongst them, MUBI UK, for example has boasted an impressive growth and reached an overall revenue of £14.7M in 2022 showing an increasing appreciation on independent films and specially curated entertainments. The acquisition of IndieFlix in 2021 also shows a positive signal on the indie film performance in the.

I suppose to review FilmSlate’s market, we should separate its SVoD service from the mainstream platforms as its direct competitors should be also independent film distributors like MUBI, IndieFlix, Kanopy and BFI player. The main advantage of these distributors is the proximity to quality film knowledge and licencing source, which naturally stretches its bargaining power against customers, and also creates the entry barrier for this market.

However, similar knowledge amongst the existing competitors also creates possible chance of substitution depending on film portfolio, platform user experience (community building, ease-of-use, etc.), and overall perceived value. That said, the high threats of substitution amongst rivalry can also cause potential intense rivalry.

Finally, about FilmSlate’s supplier bargaining power. With the size of FilmSlate (20,000 paid user), FilmSlate’s bargaining power is significantly lower than mainstream SVoD provider like Netflix, Amazon if they are to compete on bigger/more famous productions. Yet comparing to its direct competitors that of bigger customer base, FilmSlate will likely to have slightly lower bargaining power just to ensure the film portfolio to attract and retain their highly overlapped target audience.